Find out where Allstate, Progressive, State Farm, Liberty Mutual and others rank on this list of the top property casualty insurers in the US

There are about 3,700 property and liability (P&C) insurance companies in the US, but only a few of the biggest ones really rule the market. In fact, just over two-thirds of the market is controlled by the top 25 property and liability insurers in the country.

The National Association of Insurance Commissioners (NAIC) most recent market share study says that these companies have taken on about $567.8 billion in premiums. This amount is 7% more than the $530.4 billion that was made the previous year.

This piece from Insurance Business lists the biggest property and casualty insurers in the United States. Find out where the big names in the business rank on the list by reading on.

Which 25 US property and liability insurance companies are the best?

Over the years, the 25 biggest property and casualty insurers in the country have stayed mostly the same, especially in the top 10. The ranks have only changed a little. Based on the most recent data from NAIC, these companies made the list ranked by the amount of direct premiums they wrote.

1. The State Farm

Direct premiums written: $78.6 billion

Direct premiums earned: $75.1 billion

Loss ratio: 82.24%

Market share: 9.06%

State Farm is still the biggest company in the field; its premiums are nearly $23 billion higher than those of its closest competitor. The P&C giant is based in Bloomington, Illinois, and has a wide range of plans for cars, homes, and small businesses. It also offers a wide range of life, health, and disability insurance.

State Farm has 19,000 agents across the country that policyholders can call on when they need help, just like a good friend.

The business is known for having reasonable rates on car insurance. One more thing that helps is that the insurance company always does better than the average when it comes to customer happiness.

You can get to its policies either directly or through a network of insurance brokers that it works with.

There is information in this guide about how much State Farm brokers make.

2. Berkshire Hathaway

Direct premiums written: $56.0 billion

Direct premiums earned: $54.9 billion

Loss ratio: 77.05%

Market share: 6.45%

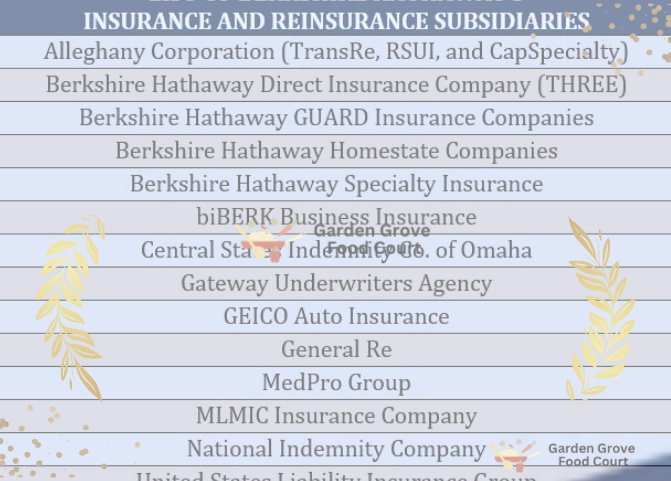

Berkshire Hathaway is the parent company of the well-known car insurance company GEICO. It also owns a number of other insurance and reinsurance companies, including property and casualty insurers and life and health experts. The following companies are shown in the table:

Warren Buffet is the head and CEO of Berkshire Hathaway and is thought to be the richest insurance magnate in the US. Forbes says that the guy known as the “Oracle of Omaha” is one of the wealthiest people in the world, with a net worth of more than $120 billion.

3. Progressive

Direct premiums written: $52.3 billion

Direct premiums earned: $50.6 billion

Loss ratio: 70.22%

Market share: 6.03%

Progressive is the number one auto insurance company in the country for motorcycles and unique RVs, but it is only number two in the country for cars, behind State Farm. The Ohio-based property and liability insurance company also provides financial services and a variety of personal and business insurance plans. You can get its insurance products straight from the company or through a network of 38,000 independent agents across the country.

4. Allstate

Direct premiums written: $45.5 billion

Direct premiums earned: $43.8 billion

Loss ratio: 75.39%

Market share: 5.24%

Many people know Allstate as one of the biggest personal lines insurers in the country. It has about 16 million customers and 175 million policies in force. The business, life, property, and car segments all offer a range of coverage from the company. People also know it as the name of well-known insurance companies like Encompass, Esurance, and Answer Financial.

Policies from Allstate are mostly offered through the company’s own agencies. These people work for the company in the US and Canada and number about 12,300.

5. Liberty Mutual

Direct premiums written: $43.9 billion

Direct premiums earned: $42.6 billion

Loss ratio: 63.63%

Market share: 5.06%

The fifth largest property and casualty insurer is also the biggest mutual insurer on the list. Liberty Mutual offers a range of insurance products and services, including:

- Commercial automobile

- Commercial multiple peril

- Commercial property

- General liability

- Homeowners

- Personal automobile

- Reinsurance

- Specialty line

- Surety

- Workers’ compensation

6. Travelers

Direct premiums written: $34.2 billion

Direct premiums earned: $32.7 billion

Loss ratio: 57.79%

Market share: 3.95%

Travelers has 8% of the business insurance market and 6% of the workers’ compensation insurance market, making it the biggest insurance company in the country. Property and casualty insurance from this company can be bought directly by customers or through a network of 13,500 independent brokers. Travelers also does business in Canada, Ireland, and the UK, as well as the US.

7. Chubb

Direct premiums written: $29.4 billion

Direct premiums earned: $28.6 billion

Loss ratio: 57.77%

Market share: 3.39%

Not only is Chubb one of the biggest insurance companies in the world by market value, it is also one of the biggest property and safety insurers in the United States. More than 50 countries and regions are served by the business.

Chubb has many types of property and casualty (P&C) insurance for businesses and people. Also, it is one of the best business lines insurers in the US.

The company also writes life, personal accident, supplemental health, and reinsurance policies, in addition to property and liability policies. Almost 40% of Chubb’s work is done outside of the United States.

8. USAA

Direct premiums written: $26.8 billion

Direct premiums earned: $26.0 billion

Loss ratio: 83.55%

Market share: 3.09%

USAA only works with people who are in the military, the reserves, veterans, and their families. This company is still one of the biggest in the country when it comes to home and car insurance. In customer satisfaction polls, the company always gets the highest marks, with scores that are often much higher than the average for the industry.

9. Farmers

Direct premiums written: $26.4 billion

Direct premiums earned: $25.7 billion

Loss ratio: 64.47%

Market share: 3.04%

Farmers consists of three reciprocal insurers, meaning they are owned and governed by policyholders. These are:

- Farmers Insurance Exchange

- Fire Insurance Exchange

- Truck Insurance Exchange

These insurance companies, along with their branches and subsidiaries, make up one of the biggest property and casualty insurance companies in the US.

Farmers has insurance for small businesses, homes, and cars. The company now has more than 48,000 employees, both full-time and part-time, who serve more than 10 million homes. It has also written more than 19 million plans for individuals in all 50 states.

10. Nationwide

Direct premiums written: $20.3 billion

Direct premiums earned: $19.8 billion

Loss ratio: 66.07%

Market share: 2.34%

Nationwide helps people all over the US with their health and finances in many ways. It sells personal and industrial insurance for cars, motorcycles, homes, pets, farms, renters, and businesses. There is also life insurance, annuities, mutual funds, retirement plans, and specialty health services from this business.

11. Zurich

Direct premiums written: $17.5 billion

Direct premiums earned: $16.8 billion

Loss ratio: 66.94%

Market share: 2.02%

Zurich is a global multiline insurance company that offers a wide range of property and casualty insurance goods. It sells personal lines insurance like home, car, general liability, and trip insurance. The big insurance company also offers many business insurance plans that protect against online risks, financial institutions, professional liability, marine risks, and trade credit.

Zurich also has health insurance, claims management, risk engineering, and captive services, in addition to P&C policies. It can be used in more than 210 countries and regions around the world.

12. AIG

Direct premiums written: $15.1 billion

Direct premiums earned: $15.0 billion

Loss ratio: 57.16%

Market share: 1.74%

American International Group, or AIG, is a global insurance company that sells a variety of business and personal insurance plans. It helps people in the US with farming risks as well as liability, specialty, financial lines, accident, and health insurance. It does business in over 70 countries and has assets worth $257 billion.

13. The Hartford

Direct premiums written: $14.6 billion

Direct premiums earned: $14.1 billion

Loss ratio: 54.27%

Market share: 1.69%

One of The Hartford’s three main business units is property and liability insurance. The other two are group benefits and mutual funds. The business has a relationship with AARP and has only sold home and car insurance to AARP members since 1984.

There are homeowners’, condo, and renters’ plans from The Hartford for home insurance. It also covers classic cars, ATVs, boats, golf carts, RVs, and snowmobiles under its auto coverage line. The business also has commercial plans for many different types of businesses, such as those in education, healthcare, manufacturing, retail, and technology.

14. American Family

Direct premiums written: $14.1 billion

Direct premiums earned: $13.2 billion

Loss ratio: 74.68%

Market share: 1.62%

American Family Insurance is one of the best property and casualty insurance companies in the country and one of the top 10 largest home and car insurance companies. The company, which is also known as AmFam, has a great track record when it comes to making customers happy. Some states are the only ones that can use its laws, though.

15. CNA

Direct premiums written: $12.7 billion

Direct premiums earned: $12.1 billion

Loss ratio: 57.53%

Market share: 1.47%

CNA Insurance offers industrial insurance and risk management services that can be changed to fit the needs of each business. Commercial car, marine, liability, workers’ compensation, and cyber insurance are some of the things it offers. Also, the business is one of the ten biggest internet insurance companies in the country. More than 70 places in the US, Canada, and Europe are home to CNA offices.

16. Tokio Marine

Direct premiums written: $11.2 billion

Direct premiums earned: $10.9 billion

Loss ratio: 62.06%

Market share: 1.29%

Okio Marine is a property and casualty (P&C) company based in Tokyo that does business in 46 countries, including the US, where it is one of the best property and casualty insurers. About a third of the insurance giant’s 41,000 employees work for clients around the world, even though most of them are based in Japan. Tokio Marine North America, Philadelphia Insurance, Delphi Financial, and Nisshin Fire & Marine are some of the names that belong to the company.

Aviation, personal lines, surety, professional lines, accident and health, and business insurance are all things that Tokio Marine offers.

17. Auto-Owners

Direct premiums written: $11.0 billion

Direct premiums earned: $10.4 billion

Loss ratio: 71.60%

Market share: 1.27%

The Michigan-based Auto-Owners Insurance is one of the biggest property and liability insurance companies in the country. About three million people in 26 states have insurance with it for their cars, homes, lives, and businesses. The company’s goods are sold by a network of 48,000 licensed insurance agents.

18. Fairfax Financial

Direct premiums written: $9.4 billion

Direct premiums earned: $8.7 billion

Loss ratio: 54.58%

Market share: 1.09%

Fairfax Financial is a financial holding company based in Toronto that sells a variety of property and casualty insurance and reinsurance goods. It also helps people with investments and insurance cases.

Fairfax has a number of companies in the US that offer a variety of P&C services to clients. These businesses are:

- Allied World

- Crum & Foster

- Odyssey

- Riverstone

- Zenith National

Fairfax also ranks second among the largest cyber insurance providers in the US.

19. W.R. Berkley

Direct premiums written: $8.8 billion

Direct premiums earned: $8.3 billion

Loss ratio: 51.42%

Market share: 1.01%

Commercial P&C insurance and reinsurance goods from W.R. Berkley are sold to niche market clients in the US and other countries. Its insurance business writes extra and surplus lines to protect against complicated risks and admitted insurance products to meet the specific needs of each client. In the meantime, W.R. Berkley’s reinsurance business helps insurance companies and self-insured businesses control their overall risk by paying for their extra.

20. American Financial

Direct premiums written: $8.5 billion

Direct premiums earned: $8.3 billion

Loss ratio: 53.48%

Market share: 0.98%

The Cincinnati-based American Financial Group is a holding company with two main business areas: insurance and investing. Its insurance division has many property and casualty policies that can be changed to fit the needs of different companies.

The company boasts among the oldest P&C operations in the US, which started in 1872.